2021-04-28

Administration and banking — Europe’s e-signature leaders

eIDAS was introduced in Poland 5 years ago — the relevant regulation came into force exactly on July 1, 2016. Since then, the trust services market has definitely grown, and its key service — the electronic signature — is an important part of the digitization of the economy. The European Commission has conducted a survey of EU member states, which shows that e-signatures are now most commonly used in the public sector and banking.

eIDAS has created an appropriate legal framework

Regulation (EU) No 910/2014 on electronic identification and trust services for electronic transactions in the internal market (known as the eIDAS Regulation) is one of the reasons why the European Union is leading the way in the use of these services for digital processes that take place between member states. The Regulation creates an internal European market for trust services consisting of: electronic signatures, electronic seals, time stamping, recorded electronic delivery and website authentication, ensuring that they will work across borders and have the same status as their traditional paper-based counterparts. It also aims to increase confidence in electronic transactions between businesses, citizens and public authorities by providing a common legal framework for cross-border recognition of an electronic identifier. The introduction of eIDAS regulations was also supposed to lead to a situation in which EU countries would mutually recognize electronic identification means, so that a citizen holding an e-signature, for example, could use it to access administration e-services in any EU country.

Who benefits from a signature?

The European Commission is closely monitoring the implementation of the eIDAS Regulation through regular dialogs with Member States. At the end of March 2021, it published key results from surveys completed by representatives of participating countries (the 27 EU Member States plus Iceland, Liechtenstein and Norway). The study was for the period of 2019 and resulted in the following information:

- 77% of all countries have fully implemented eIDAS into their national law;

- 33% of all countries have allowed the use of electronic signatures and electronic seals in their national one-stop e-government portal;

- the main providers of signing certificates are distributed almost evenly between the public (47%) and private (53%) sectors.

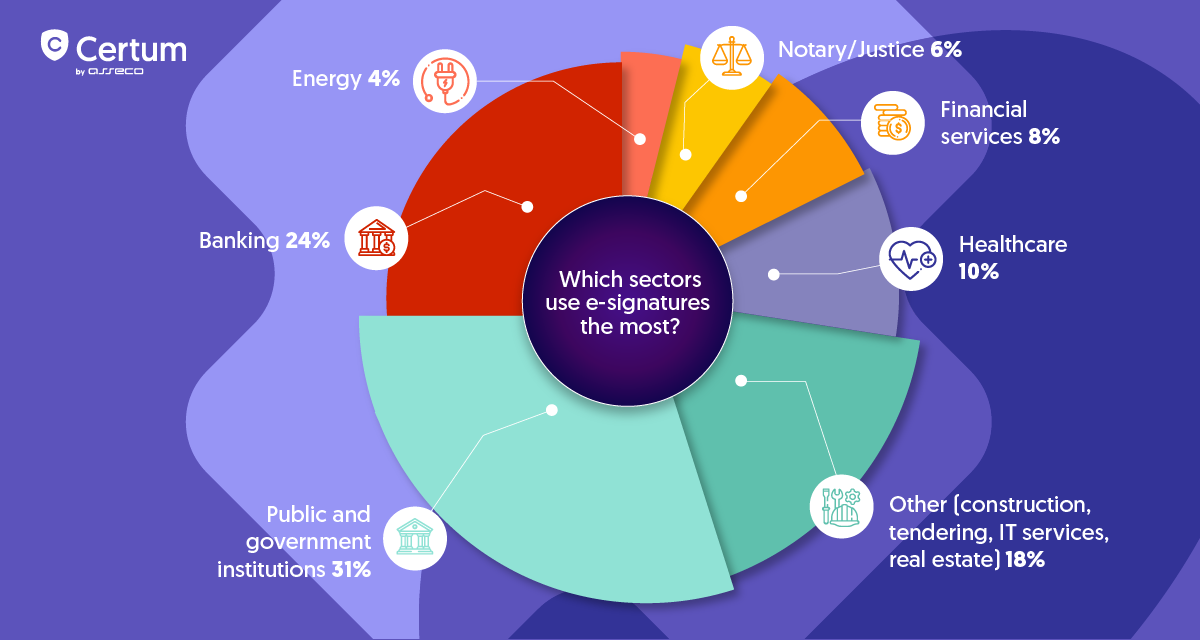

The areas where electronic signatures are most commonly used are the public sector and government institutions (31%) as well as banking (24%), while lower levels were reported in other sectors such as energy (4%) and among notaries/legal industry (6%). This data shows positive trends in the use of trust services in the internal market. And while there is still a long way to go for trust services to penetrate all sectors and industries, many European administrations, businesses and citizens are using trusted digital processes, including across borders.

Source: European Commission data based on: Current situation of electronic signatures and electronic seals in the EU. National information on electronic signatures and electronic seals. Information obtained from the 2019 National E-Signature Worksheets

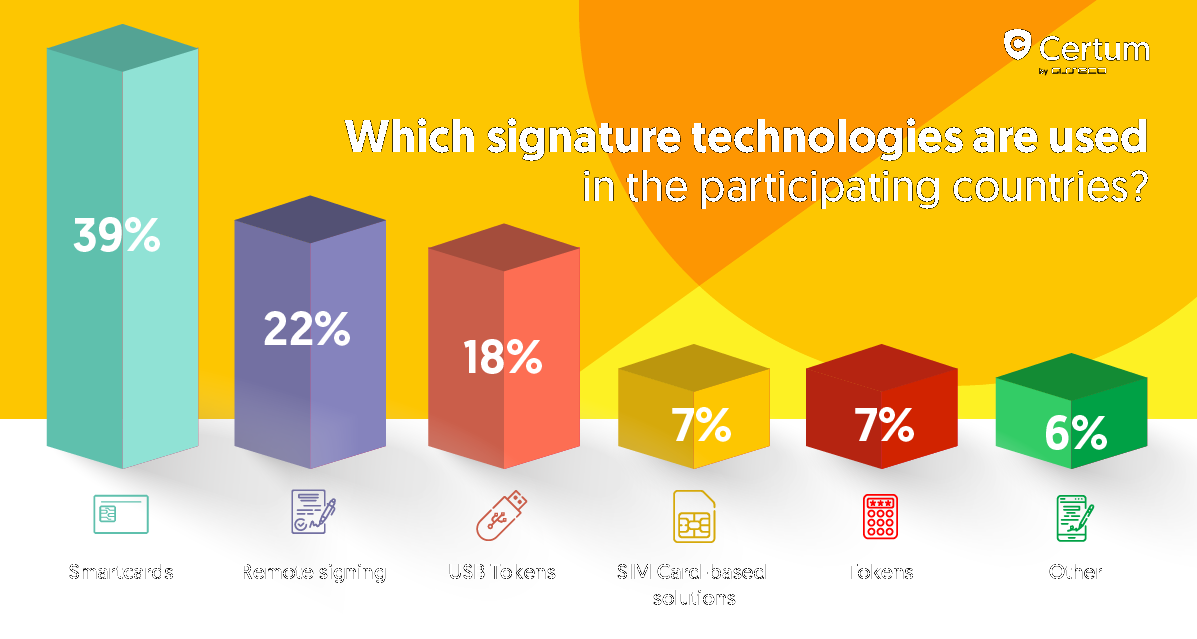

Of all the countries participating in the survey, 26 provided information on the technology used to create electronic signatures, with smart cards being the most popular (39%), followed by remote signing (22%) and USB tokens (19%). Alternatives included SIM card-based solutions (7%), tokens (7%) and other technologies (6%). The demand for cloud-based digital signatures for seamless and secure transactions will drive the digital signatures market in the region; this will be aided by mobility and the use of smartphones as a primary tool for communication. Also, user preferences mean that classic physical media are no longer popular in favor of applications and cloud solutions.

Source: European Commission data based on: Current situation of electronic signatures and electronic seals in the EU. National information on electronic signatures and electronic seals. Information obtained from the 2019 National E-Signature Worksheets

In addition to areas of e-signature use, data was also collected on activities and outreach methods related to e-signatures. The most commonly used channel is official government or trust service provider websites (64%). Unfortunately, other channels of informing the public, such as public campaigns (12%), chats/e-mails/text messages (9%) and informing through news or advertisements (15%) are not very popular.

Market differences

The digital signature market in Europe, unlike the market in the United States, is dynamic and fragmented, with many niche and established vendors that focus exclusively on the digital signature market. There are currently 201 active trust service providers in the European Union, with the highest number in Spain (36), France (24) and Italy (22), but there are also countries in Europe where there are none — the UK or Denmark, or there is only one — Finland, Latvia, Iceland, Switzerland, Cyprus. The European market for qualified trust service providers has grown significantly in recent months — the expansion of the market is primarily due to the availability and consolidation of electronic identification tools (e.g. video-verification) that support the registration and identification processes for new trust services internationally.

Number of qualified trust service providers in the European Union

| Qualified electronic signature — QES | Qualified electronic seal — QESeal | Qualified time stamp Qtimestamp | Qualified Electronic Delivery — QRDS | Qualified Web Authentication Certificate QWAC | Total active qualified QTSP providers | |

| Number of providers | 156 | 106 | 114 | 20 | 52 | 201 |

Electronic signatures in European countries will be driven by high demand for advanced security solutions and improved customer service, regardless of economic conditions. Security in ever-growing e-commerce and mobile payments will encourage organizations to integrate e-signature solutions and services that will drive the European e-signature market.

Challenges — remote identity confirmation

The European electronic signature market has reached a level of maturity for qualified services. Having saturated the sales potential from regulations, the focus is shifting to business use, in the broader context of digital transformation, especially in the current pandemic situation. Electronic document processing has improved operational efficiencies, reduced operational costs, and accelerated decision-making processes. The challenge in the next years will be the full acceptance and use of remote identity verification in each European country. So far this is not standard and in some countries physical presence during a personal meeting with a representative of the signature provider is required to obtain a qualified electronic signature. In order to keep up with the technology and accept electronic document processes, governments and businesses should organize electronic signature awareness programs and engage in campaigns to spread awareness of the legal acceptance and benefits of electronic signatures over classic signatures. IDC experts estimate that 65% of the world’s GDP will be digitized by 2022, and digital signature solutions will automate business processes to drive this digital transformation. At the same time, users expect these processes to be easy to use, provide flexible availability with a high level of security, and be legally compliant. Electronic signature provides security and increases trust in the business process, thus playing a key role in transactional business processes.